As a outcome, the ledger offers a detailed account-by-account document of all company transactions. We can obtain complete details about any single account utilizing a ledger since all linked journal entries are printed on continuous pages of this e-book. Well, your trial steadiness is like the memo that summarizes the data in your submitting cabinet. You primarily use your trial steadiness as an outline and summary of your common ledger. Ready to dive in and be taught the distinction between basic ledger vs. trial balance?

- They each have their respective significance and timing within the business cycle.

- In contrast, the company’s trial balance has only the ending stability present in these accounts of the corporate.

- Companies depend on basic ledgers for financial transparency, informed decision-making, financial statement preparation, tax compliance, error detection, and accurate business valuation.

- In conclusion, the Common Ledger and Trial Steadiness are important elements of financial accounting, each with its own attributes and functions.

A trial balance verifies your accounting books are accurate and error-free. Modern companies increasingly depend on specialized software program to handle their general ledger accounting processes. This know-how has reworked traditional bookkeeping into a extra efficient, correct, and insightful financial management system.

Compare Your Debit And Credit Balances

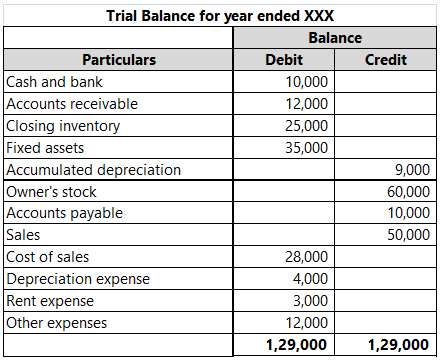

You have control via search settings to evaluation the account you want to see within the general ledger. In the tip, you’ll find a way to either transition to view the primary points of the entry you need by clicking on it or download the ledger report in the format you specify. After recording the entire credit and debit balances of the various common ledger accounts in the trial stability columns. Following the calculation of the closing balances of each account for the accounting period. The calculated steadiness must be transferred to the trial steadiness with their debit and credit balances. The trial steadiness, in contrast, summarizes the total debit and credit balances of every account at a selected second.

Accurate financial statements provide a transparent image of a company’s financial well being and performance. It is prepared on the finish of an accounting period (like a month or year) and lists all accounts with their last debit or credit score steadiness. The major function of a trial balance is to ensure that all of the debits and credit recorded within the basic ledger are in balance (i.e., the whole debit balances equal the whole credit score balances). Understanding the financial well being of any enterprise requires a firm grasp of its accounting practices.

You must refer back to your basic ledger to find out the place the error is. Companies, accountants, and bookkeepers all use trial balances to verify a company’s books are accurate. A basic ledger summarizes all of the transactions entered by way of the double-entry bookkeeping method. Underneath this method, each transaction impacts at least two accounts; one account is debited, while another is credited. The common ledger capabilities as the central nervous system of a company’s financial operations, enabling businesses to monitor efficiency and make knowledgeable choices.

It accommodates all accounts, together with assets, liabilities, income, and expenses. It may also embody sub-ledgers for extra particular classes, corresponding to accounts receivable and accounts payable. Operating a enterprise means juggling a selection of monetary stories, like your company’s trial balance and common ledger.

General Ledger And Trial Stability: What’s The Difference?

As an example, suppose you wish to submit a revenue transaction to an expense account. Create a table or spreadsheet with three separate columns labeled “The names of every ledger account”, “Debit” and “Credit Score” and the balance of each account. A subsidiary ledger (sub-ledger) is a sub-account associated to a GL account that traces the transactions corresponding to a specific firm, purchase, property, and so forth.

A general ledger is the grasp set of that summarize all occurring inside an entity. The basic ledger is comprised of all the individual accounts needed to report the , , , , , , and transactions of a enterprise. The is a report run at the end of an accounting interval, listing the ending balance in each account.

Your trial steadiness signifies the place you’ve some wiggle room and offers you an idea of how your price range might look. But should you do, your trial stability is a good place to look to find out if your small business is on the proper path financially. When reviewing your books on the finish of the month, use your trial steadiness. The trial stability sheet particulars the basic information essential to carry out a wellness examine https://www.quickbooks-payroll.org/ on your books.

Balance sheets depend on asset, legal responsibility, and equity accounts from the overall ledger. These permanent accounts carry forward their balances from one interval to the next, creating a snapshot of what the company owns, owes, and the shareholders’ residual interest general ledger vs trial balance. Revenue statements draw instantly from revenue and expense accounts within the basic ledger. These accounts monitor all gross sales, service revenue, and bills, permitting accountants to calculate the company’s internet earnings or loss.